Named  Krung Thep Mahanakhon Amon Rattanakosin Mahinthara Ayuthaya Mahadilok Phop Noppharat Ratchathani Burirom Udomratchaniwet Mahasathan Amon Piman Awatan Sathit Sakkathattiya Witsanukam Prasit, (a Guinness record for the world’s longest name for a place) or, in short Krung Th ep Maha Nakhon or more popularly – Bangkok. Simply translated, the name means, ‘the city of angels, the great city, the eternal jewel city, the impregnable

Krung Thep Mahanakhon Amon Rattanakosin Mahinthara Ayuthaya Mahadilok Phop Noppharat Ratchathani Burirom Udomratchaniwet Mahasathan Amon Piman Awatan Sathit Sakkathattiya Witsanukam Prasit, (a Guinness record for the world’s longest name for a place) or, in short Krung Th ep Maha Nakhon or more popularly – Bangkok. Simply translated, the name means, ‘the city of angels, the great city, the eternal jewel city, the impregnable  city of God Indra, the grand capital of the world endowed with nine precious gems, the happy city, abounding in an enormous Royal Palace that resembles the heavenly abode where reigns the reincarnated God, a city given by Indra and built by Vishnukam’!

city of God Indra, the grand capital of the world endowed with nine precious gems, the happy city, abounding in an enormous Royal Palace that resembles the heavenly abode where reigns the reincarnated God, a city given by Indra and built by Vishnukam’!

From being a small trading town, Bangkok has metamorphosed into one of the most happening cities of Asia. During the reign of King Buddha Yodfa Chulaloke, the city was bestowed with its ceremonial name and the official name remained Krung Th ep Maha Nakhon.

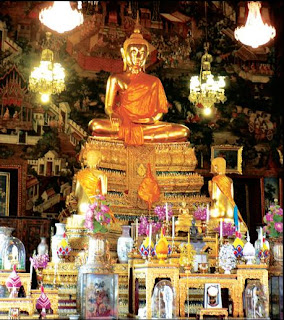

Set on the bank of the Chao Phraya River in Thailand, Bangkok holds time – past, present and future – together in its arms. After all, where else can one find skyscrapers kissing the azul skies beside the most ancient temples or wats, where the monks live in harmony with all the glitz and glamour that’s associated with its name!

on the bank of the Chao Phraya River in Thailand, Bangkok holds time – past, present and future – together in its arms. After all, where else can one find skyscrapers kissing the azul skies beside the most ancient temples or wats, where the monks live in harmony with all the glitz and glamour that’s associated with its name!

Counted among the world’s top tourist destinations and ranked third (by Travel + Leisure), Bangkok is host to more than 15 million tourists each year, boasting of its most visited historical venues – the Grand Palace, Wat Pho, Wat Phra Kaew (which houses the emerald Buddha and is considered the most important temple in Thailand), Wat Arun et al.

the most important temple in Thailand), Wat Arun et al.

Besides, the city boasts of an effervescent night life, teeming with Asia’s most premium clubs and bars thriving in its ubercool lifestyle! And, if the floating markets, dinner cruises and bargain shopping don’t amuse you, indulge in some Thai massage and out-of-the-world spa treatments for a quick detox! Bangkok beckons for the sheer ecstasy that ceases to end!

For Complete IIPM Article, Click here

Source: IIPM Editorial, 2008

An IIPM and Management Guru Prof. Arindam Chaudhuri's Initiative

Krung Thep Mahanakhon Amon Rattanakosin Mahinthara Ayuthaya Mahadilok Phop Noppharat Ratchathani Burirom Udomratchaniwet Mahasathan Amon Piman Awatan Sathit Sakkathattiya Witsanukam Prasit, (a Guinness record for the world’s longest name for a place) or, in short Krung Th ep Maha Nakhon or more popularly – Bangkok. Simply translated, the name means, ‘the city of angels, the great city, the eternal jewel city, the impregnable

Krung Thep Mahanakhon Amon Rattanakosin Mahinthara Ayuthaya Mahadilok Phop Noppharat Ratchathani Burirom Udomratchaniwet Mahasathan Amon Piman Awatan Sathit Sakkathattiya Witsanukam Prasit, (a Guinness record for the world’s longest name for a place) or, in short Krung Th ep Maha Nakhon or more popularly – Bangkok. Simply translated, the name means, ‘the city of angels, the great city, the eternal jewel city, the impregnable  city of God Indra, the grand capital of the world endowed with nine precious gems, the happy city, abounding in an enormous Royal Palace that resembles the heavenly abode where reigns the reincarnated God, a city given by Indra and built by Vishnukam’!

city of God Indra, the grand capital of the world endowed with nine precious gems, the happy city, abounding in an enormous Royal Palace that resembles the heavenly abode where reigns the reincarnated God, a city given by Indra and built by Vishnukam’!From being a small trading town, Bangkok has metamorphosed into one of the most happening cities of Asia. During the reign of King Buddha Yodfa Chulaloke, the city was bestowed with its ceremonial name and the official name remained Krung Th ep Maha Nakhon.

Set

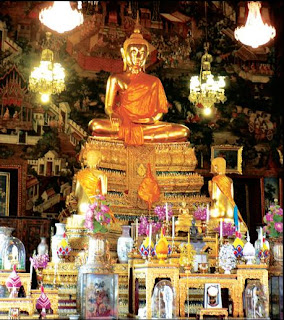

on the bank of the Chao Phraya River in Thailand, Bangkok holds time – past, present and future – together in its arms. After all, where else can one find skyscrapers kissing the azul skies beside the most ancient temples or wats, where the monks live in harmony with all the glitz and glamour that’s associated with its name!

on the bank of the Chao Phraya River in Thailand, Bangkok holds time – past, present and future – together in its arms. After all, where else can one find skyscrapers kissing the azul skies beside the most ancient temples or wats, where the monks live in harmony with all the glitz and glamour that’s associated with its name!Counted among the world’s top tourist destinations and ranked third (by Travel + Leisure), Bangkok is host to more than 15 million tourists each year, boasting of its most visited historical venues – the Grand Palace, Wat Pho, Wat Phra Kaew (which houses the emerald Buddha and is considered

the most important temple in Thailand), Wat Arun et al.

the most important temple in Thailand), Wat Arun et al.Besides, the city boasts of an effervescent night life, teeming with Asia’s most premium clubs and bars thriving in its ubercool lifestyle! And, if the floating markets, dinner cruises and bargain shopping don’t amuse you, indulge in some Thai massage and out-of-the-world spa treatments for a quick detox! Bangkok beckons for the sheer ecstasy that ceases to end!

For Complete IIPM Article, Click here

Source: IIPM Editorial, 2008

An IIPM and Management Guru Prof. Arindam Chaudhuri's Initiative

IIPM Arindam Chaudhuri 4Ps Business & Marketing Business & Economy Kkoooljobs Planman Media Planman Consulting Planman Marcom Planman Technologies Planman Financial Planman Motion Pictures GIDF The Daily Indian IIPM Think Tank

The Sunday Indian